What Does Why Detroit Is The Most Expensive City In America To Buy Car ... Do?

If your insurance firm thinks you're likely to make a claim, your rates will rise. Insurers consider many variables when setting prices, however here are several of the most usual factors some vehicle drivers pay a lot for car insurance. laws. Your insurer It might appear obvious, however insurance coverage rates differ considerably amongst insurance policy companies, and if you're buying a plan from a pricey insurer, you can be paying a lot more than you need to be (auto).

That precise same motorist could be paying as little as $309 from State Farm or as much as $625 from Allstate. Changing from Allstate to State Farm would bring that driver's rate down by 51%. The only method to guarantee you're paying the most effective cost readily available to you is to search and also accumulate quotes from multiple insurer.

5 times more costly than for adult chauffeurs in their mid-30s (vehicle insurance). The major factor for these high prices is that young vehicle drivers are statistically more probable to enter into cars and truck crashes that cause expensive cases for insurance companies. Boy are particularly likely to pay a lot for vehicle insurance. insurance companies.

cheaper auto insurance cars vehicle vans

The distinction levels as chauffeurs obtain older, and also older females in fact pay somewhat more than men of the very same age though only by a few dollars a month.: One of the best methods for more youthful chauffeurs to lower their premiums is to share a plan with an older member of the family - trucks.

Younger chauffeurs can additionally receive good pupil discount rates or take extra training programs to bring rates down a lot more (prices). Where you live The expense of auto insurance coverage varies wildly throughout the USA. Residents of one of the most pricey state for vehicle insurance coverage, Michigan, can expect to pay than people that live in Maine.

Facts About What Age Does Car Insurance Go Down? - Policygenius Revealed

insurance company cheapest auto insurance cheapest car auto insurance

The expense of insurance policy can differ within a state or even within a city, as well. If you reside in an area with high rates of car burglary, or with narrow roads that cause a great deal of mishaps, you may pay more than you would certainly elsewhere. We located a $618 price difference in between the most inexpensive and also most costly ZIP codes for - risks.

automobile cheaper auto insurance cheaper cars low cost auto

If you're currently assuming of moving, it can be beneficial to obtain a couple of example insurance coverage prices quote to recognize just how rates will certainly vary in your new residence. Your cars and truck insurance policy protection options The more auto insurance coverage you buy, the more you can anticipate to pay. We located that a full insurance coverage policy, which consists of extensive as well as accident insurance, costs our account chauffeur 170% more in yearly premiums than one with responsibility insurance coverage only (vehicle).

Plans that consist of high obligation restrictions along with detailed and crash protection with low deductibles are specifically pricey. We found the expense of a plan such as this to be $1,053 even more per year for our account vehicle driver compared to the price of a (cheap car insurance).: You have complete control over the protection on your plan, so you can easily decrease your restrictions so long as you're above the legal limit and satisfy any requirements your loan provider has.

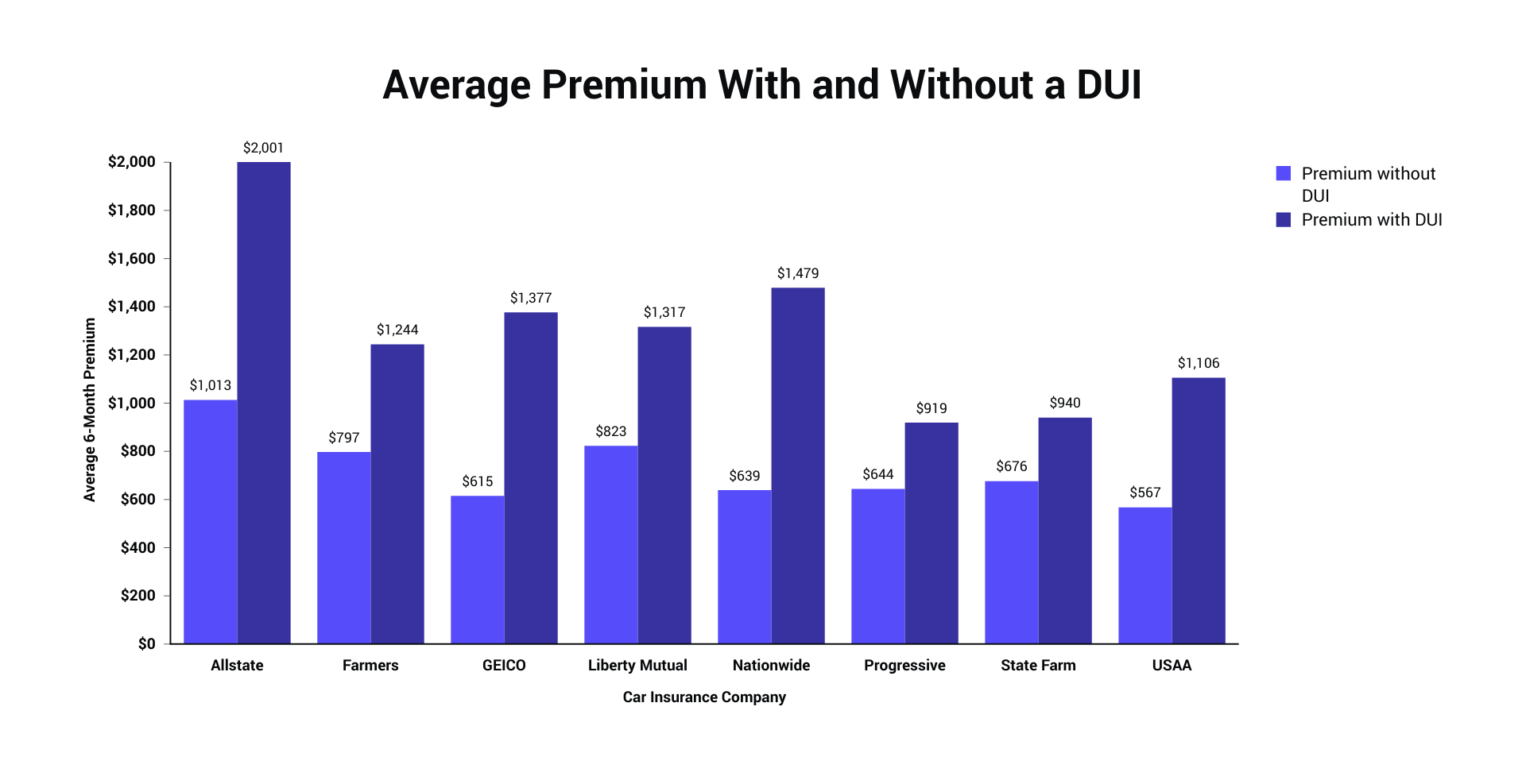

Your driving record Vehicle drivers with current mishaps or web traffic offenses on their records generally pay considerably higher auto insurance prices than vehicle drivers with clean documents - cheaper cars. According to our evaluation, grown-up motorists that were recently at mistake in an accident than those without any mishaps or offenses - insurance. The factor for this inconsistency in rates is that these motorists are statistically more probable to be associated with a future accident.

This is a sort of insurance plan for risky chauffeurs, for which they are required to have their insurance provider file an SR-22 form on their part that proves that they have actually the needed minimum automobile insurance coverages.: Some states allow you to decrease the result of a ticket on your record by taking a defensive driving program.

Unknown Facts About Why Is My Renters Insurance - Atlanta, Ga So Expensive?

Vehicles with the complying with qualities often tend to be more expensive to guarantee: Newer Faster/more effective Much more costly Smaller sized: If you have a cars and truck that has particularly high rates, like a luxury automobile, an exchangeable or a muscular tissue vehicle like a, switching over automobiles may result in a big financial savings on your insurance policy costs. insurance.

The reason pay even more for car insurance coverage coincides as the reason for other ranking aspects: They are statistically more probable to sue versus their insurance than those with great credit - risks. However, numerous states, including California, Hawaii and Massachusetts, need to compute car insurance policy rates. If you live in among these states, your prices will certainly not be influenced by your credit rating.

Beyond that, one of the most crucial point is to pay your bank card and also various other costs in a timely manner. See here for even more pointers on how to enhance your credit report. vehicle insurance. More means to conserve on insurance coverage If your automobile insurance is also expensive, there are a variety of actions you can require to decrease your rate.

car insurance low-cost auto insurance insurance affordable insurance

These prices were openly sourced from insurance company filings as well as should be made use of for relative functions just your very own quotes might be different - cheaper.

Your automobile insurance costs are Browse this site in some means a representation of you, with the rates you pay based upon variables such as your driving record as well as where you live. If your premiums seem expensive or have actually skyrocketed in current months, there are a range of possible reasons for it. vehicle.

Our 5 Causes Of Insurance Premium Increases - Nationwide Blog PDFs

cheap car insurance cars vans risks

https://www.youtube.com/embed/PY2NIxA2Vao

Americans paid approximately $1,633 in 2021, with forecasts for 2022 approximated at $1,706. The typical American pays roughly $136 per month for car insurance coverage, according to Insurify, the insurance comparison cost internet site. However that's just a standard, of program, and the rate you pay could be higher or lower, relying on various factors, such as: When you ask for a quote from a car insurance supplier, one of the things they consider is your driving document, which can consist of any kind of website traffic tickets you've obtained or crashes you have actually experienced.